child care tax credit 2020

Nearly all families with kids will qualify. Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8000.

Child Tax Credit Schedule 8812 H R Block

Starting in 2021 the Child and Dependent Care Tax Credit became a refundable tax credit in contradistinction to a nonrefundable tax credit.

. But for 2021 that would result in a 4000 credit. For 2021 expenses you can claim up to 8000 for one child or dependent and up to 16000. The maximum amount of qualified expenses youre allowed to calculate the credit is.

The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. Prior to the American Rescue Plan parents. Combined with the 2021 child tax credit changes this credit can really help families better their finances.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Couples making less than 150000 and single parents also called Head of Household making less than 112500 will qualify for the additional 2021 Child Tax Credit amounts. 150000 for a person who is married and filing a joint return.

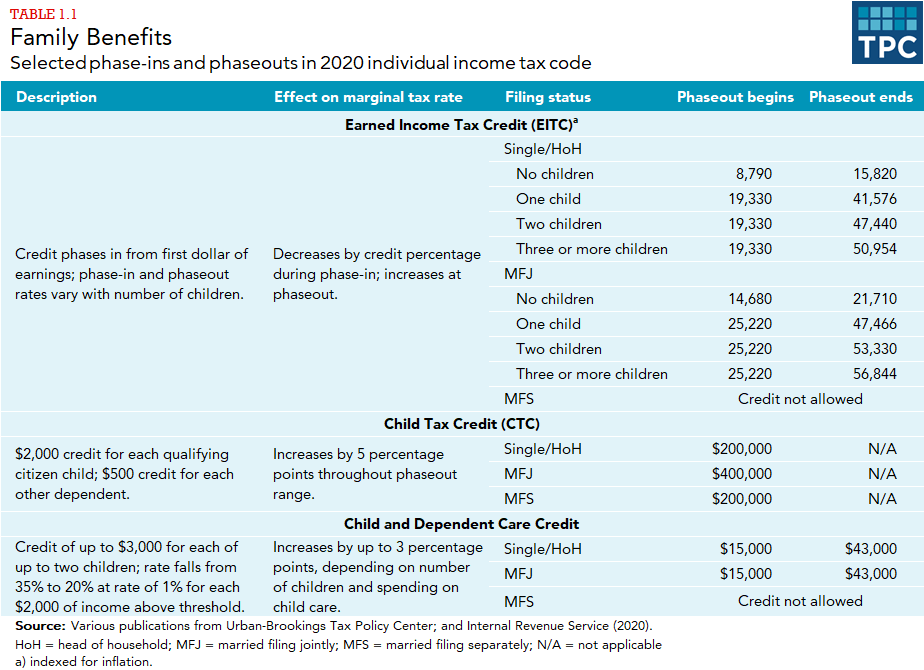

How much was the Child and Dependent Care Credit worth in previous years. Sometimes before and after-school programs qualify but it must be for the care of the child rather than just leisure. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses.

The Keep Child. 51 minus 2 percentage points for each 3600 or part of above 60000. This means that if your income is such that you actually dont owe any taxes or because tax credits and tax breaks eliminate your tax burden you can still claim a CDCTC and receive a refund from the IRS.

Official Code 47-180615. The exact amount depends on the number of children and the amount you spent on childcare. Visit bitly3y5VGU2 to learn more.

59 minus 2 percentage points for each 5000 or part of above 40000. See information on foster children and taxes. For 2020 that would result in a 600 credit.

You qualify for the child care tax credit as long as you. The Child Tax Credit is a tax benefit to help families who are raising children. Calculating How Much the Credit is Worth to You.

This summary applies to. The child care tax credit was lower in previous years. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer.

The Child Tax Credit is worth up to 2000 for each dependent child under the age of 17 at the end of the tax year. Tax credit for childcare expenses 2021. Tax credit for childcare expenses 2021.

In previous years the maximum amount you could claim was 3000 for one child or 6000 for two or more. Costs at the kindergarten level such as nursery school can qualify. Calculating the Child and Dependent Care Credit until 2020.

The advance is 50 of your child tax credit with the rest claimed on next years return. Paying for childcare and dependent care can be. For tax year 2020 the maximum amount of care expenses youre allowed to claim is 3000 for one person or.

It also provided monthly payments from July of 2021 to December of 2021. Ad The new advance Child Tax Credit is based on your previously filed tax return. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross income.

For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75. 3000 for one qualifying person. Well assume you paid 8000 in qualifying child care expenses for an 8-year-old child each year.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. Advance child tax credit payments.

Law 23-0016 and is codified in DC. From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. You can find more details.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Greater than 60000 and up to 150000. A taxpayer who makes a monetary contribution prior to January 1 2020 to promote child care in the state is allowed an income tax credit that is equal to 50 of the total value of the contribution.

To qualify for the credit your dependent must have lived with you for more than half the. In 2020 the credit was worth up to 3000 for one dependent and 6000 for two or more dependents. The maximum Child Tax Credit that parents can receive based on their annual income.

There is no upper limit on income for claiming the credit. For 2020 this credit was worth up to 20 to 35 of up to 3000 of child care or similar costs for a child under 13 or up to 6000 for 2 or more dependents. If you cant claim the Child and Dependent Care Credit or are looking for more ways to reduce your tax bill consider these tax credits and deductions.

Complete IRS Tax Forms Online or Print Government Tax Documents. In other words families with two kids who spent at least 16000 on day care in 2021 can get 8000 back from the IRS through the expanded tax credit. This tax season an often overlooked tax credit could put up to 8000 back in families pockets.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. April 25 2022. Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC is a refundable income tax credit that was enacted in the Fiscal Year 2020 Budget Support Act of 2019 effective September 11 2019 DC.

The expanded Child and Dependent Care Credit allows eligible taxpayers to claim a credit worth up to 4000 in care expenses paid for one qualifying dependent or 8000 for two or more dependents. The higher your income the smaller your percentage and therefore the smaller your credit. Who qualifies for the Child and Dependent Care Credit.

This credit has been greatly changed as part of the third stimulus plan or American Rescue Plan Act. The percentage depends on your adjusted gross income AGI. For 2021 Returns only as part of the American Rescue Plan Act the Child and.

For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses. Consider smart moves for any tax refunds. The act extends the credit for 5 more years.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

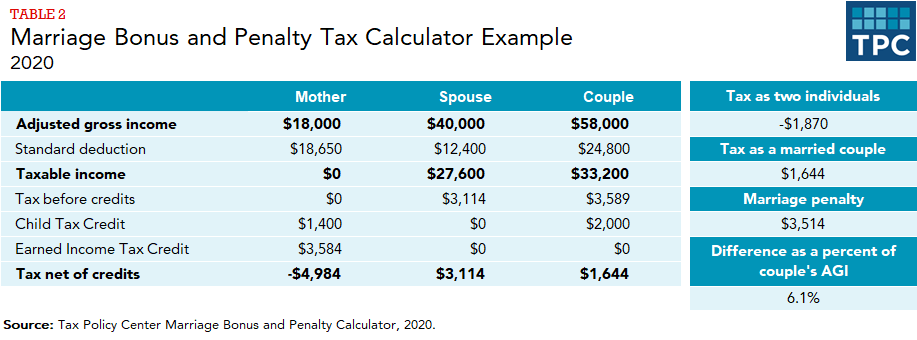

What Are Marriage Penalties And Bonuses Tax Policy Center

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

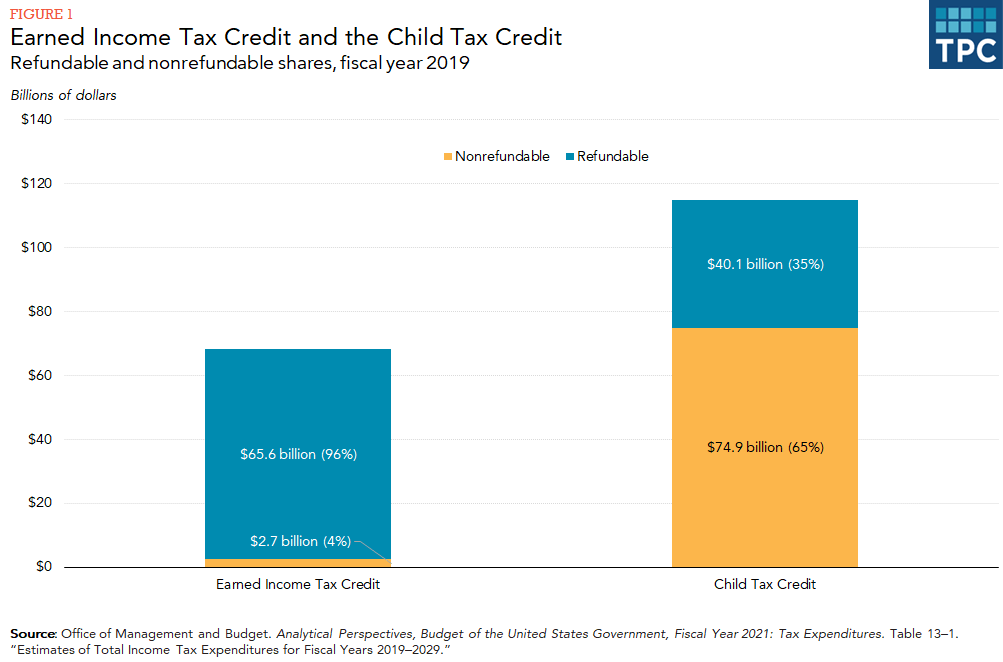

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

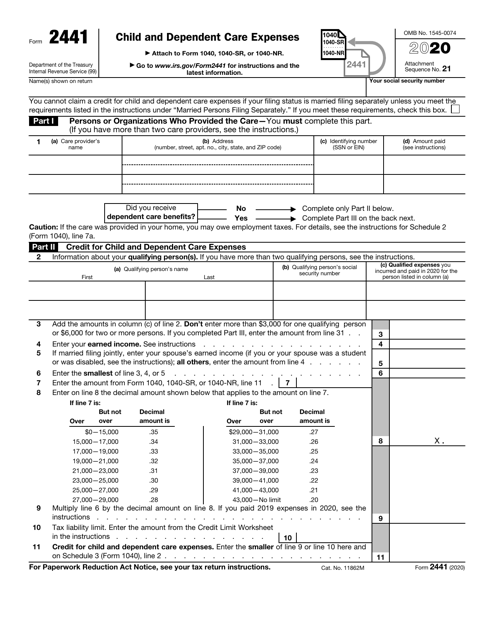

Irs Form 2441 Download Fillable Pdf Or Fill Online Child And Dependent Care Expenses 2020 Templateroller

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)